Imagine this: you’re at an ATM that looks totally normal. You insert your card, enter your PIN, and walk away, not knowing you’ve just fallen victim to a sneaky card skimmer.

The next thing you know, your bank account is drained, you find mysterious charges popping up across the globe, or even worse, your identity could be hijacked, leading to a credit score nightmare and countless hours spent trying to reclaim your financial security.

ATM skimmers are stealthy devices that can steal your card info in an instant. It’s crucial to know how to spot and avoid an ATM skimmer. This article offers a practical guide to recognize skimmers and take proactive steps to protect your finances.

On This Page:

Key Takeaways

Credit card skimmers are devices illegally installed on ATMs or point-of-sale systems to steal your card data and PINs. They often appear as misaligned/bulky readers or loose parts.

To safeguard against skimming, stay alert by examining ATMs for any signs of tampering, shielding the keypad while entering your PIN, and consistently reviewing your bank statements for any unauthorized charges.

Despite advancements in card security, such as chip technology, criminals have adapted with methods like ‘shimming,’ so ongoing awareness and reporting of suspicious activity are crucial.

What is a Card Skimmer?

An ATM skimmer is a deceptive device that thieves install on ATMs to stealthily capture your card details and PIN. These illegal devices are cleverly disguised as part of an ATM or point-of-sale system. They’re attached to the card reader, blending seamlessly with the machine. As you carry out your transaction, they’re silently stealing your card information, including your precious PIN.

These credit card skimmers often target point-of-purchase machines like gas pumps, ATMs, and transit ticket dispensers. The criminals install these skimming devices either over the card slot or by installing fake PIN pads. Their aim is simple: to steal and use your card information for fraudulent activities.

In this article, we will be focusing on card skimmers placed on ATMs, intended to steal your bank debit card information.

Recognizing ATM Skimmers: Key Indicators

But wait, all hope isn’t lost. There are ways to outsmart these tech-savvy thieves! Key indicators like misaligned or bulky card readers, loose parts and components, and hidden cameras or suspicious holes near the keypad can help you spot an ATM skimmer.

Misaligned or Bulky Card Readers

Ever notice an ATM card reader that looks a bit ‘off’? Maybe it is too bulky or appears loose or damaged. This could be the work of an ATM skimmer. These devices often fit over the original card reader and may appear bigger or misaligned. They might also make it difficult for your card to enter the machine, or the cover may seem loose-fitting or oversized. If you notice these signs, don’t proceed with your transaction and alert your credit card issuer immediately.

A genuine credit card reader is usually well-built with no loose parts and sits flush or recessed inside the machine. On the contrary, modified readers may have loose parts and stick out from the machine, indicating a card skimmer. So, if you encounter a big, chunky ATM card reader with an unusual card slot, that’s a big red flag! It might mean there’s a skimming device attached to it. Let the bank know immediately.

Loose Parts and Components

Apart from bulky readers, another telltale sign of skimming is loose parts or components on the ATM or card reader. Skimmers often attach an electronic device to the actual card reader or keypad to steal credit card information.

When you approach an ATM, look for signs of tampering, such as loose wires, seams that aren’t flush, slots or keypads that aren’t properly aligned, or scratches around the screen, keypad, or card reader. Also, if you notice glue, tape, or sticky residue on these parts, it’s best to report the issue to the service provider.

Now, let’s talk about hidden cameras. These tiny invaders often hide in plain sight on or around ATMs. Skimmers cleverly disguise these cameras to blend in with other parts of the machine and steal credit card information.

But what about those suspicious holes in an ATM? Well, those could be housing hidden cameras or devices used for card skimming. Keep an eye out for strange bumps or odd things around the ATM, and always cover the keypad when punching in your PIN to stay safe from hidden cameras.

Remember, if anything looks fishy, it’s better to be safe than sorry and avoid using that ATM.

Preventing ATM Skimming: Proactive Measures

Alright, we now know what to look out for, but how can we actively avoid these skimming devices?

Let’s dive into these preventative measures one by one.

Choosing a Secure ATM Location

The location of an ATM can significantly influence its security. ATMs in well-lit, busy areas with a good reputation are the safest. An ATM that’s well-secured – bolted to the floor or secured to the wall – is less likely to be tampered with or stolen.

Conversely, ATMs situated in isolated or neglected areas are often easy targets for skimming incidents. ATMs in financial institutions, bank lobbies, or busy supermarkets are safer because they are in highly visible areas, making it harder for potential credit card skimmers to go unnoticed.

So, next time you’re withdrawing cash or checking your balance, consider the location of your ATM.

Covering the Keypad When Entering Your PIN

An additional step you can take to protect yourself is to shield the PIN pad while inputting your PIN at an ATM. This simple action can prevent a hidden camera from recording your PIN.

ATM manufacturers are also stepping up their game to ensure the security of your PIN. They’re introducing PIN protection devices that act as a shield, keypad covers for extra security, and UV-C light devices to disinfect keypads.

Regularly Monitor Bank Accounts

Regularly checking your bank accounts is an effective strategy to thwart card skimming. It allows you to catch any unauthorized transactions or suspicious activity quickly. If you spot anything out of the ordinary, report it to your bank immediately to halt further fraudulent activity and minimize potential losses.

Try to check your bank account at least a couple of times a week. This proactive approach not only minimizes fraud and fees but also helps you stay on top of your finances. Keep in mind, staying alert is your strongest shield against ATM skimming.

The Evolution of ATM Skimming Technology

ATM skimming isn’t a recent menace. Indeed, it’s been an issue since as far back as 2002. What’s alarming is how this technology has evolved. From basic devices that were easily detectable, skimming technology has advanced to more discreet and efficient models, making it harder to spot and prevent skimming.

Modern debit and credit card skimmers are designed to blend in and operate unnoticed. They can capture card data and even have hidden cameras or fake keypads to capture PINs. Additionally, the advent of 3D printing technology has allowed criminals to create parts for skimmers that look almost identical to real ATM parts, making detection even more challenging.

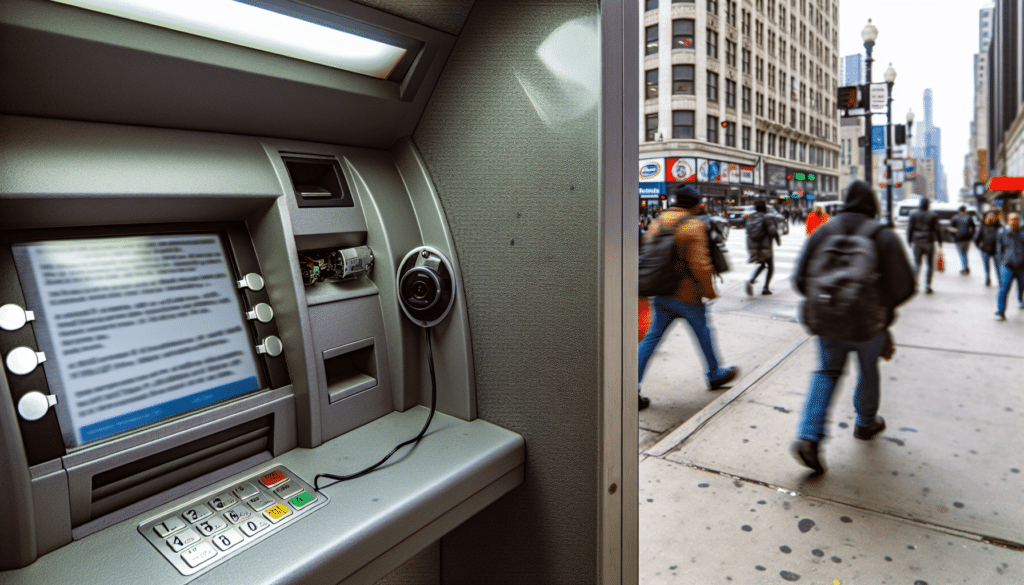

For example, here are some photos of an incredibly thin credit card skimmer attached to an ATM’s side. If you weren’t paying attention, would you have noticed this?

Understanding the Risks of ATM Skimmers

ATM skimmers present considerable threats to cardholders. They steal card data and gain access to bank accounts, leading to financial loss. Skimmers can gather all the data they need to produce fake credit or debit cards and carry out unauthorized transactions, leaving victims with empty bank accounts.

ATM skimmers can also contribute to identity theft. They can capture information from the magnetic strip of a card, which can then be used to steal the victim’s identity or make counterfeit credit and debit cards.

Chip Cards and Skimming: Are They Safer?

One might assume that chip cards would solve all our skimming issues. After all, they are supposed to be more secure than magnetic stripe cards, right? Unfortunately, skimming has evolved right along with card technology. Chip cards are indeed more secure, but they are not immune to skimming.

Enter shimming, a new threat targeting chip cards.

Chip Card Security Features

Also referred to as EMV cards, chip cards feature a microchip that generates a distinct transaction code each time a credit or debit card is used. This makes it difficult for scammers to copy or steal your credit and debit card info, unlike the static data on magnetic strip cards.

While chip cards offer a more secure alternative to traditional cards, they are not foolproof. They store dynamic information that changes with each transaction, making it tough for fraudsters to clone or counterfeit the card. However, they can still fall victim to skimming if the skimming device is sophisticated enough.

Shimming: A New Threat for Chip Cards

Shimming is a more recent form of skimming designed specifically to exploit chip cards. A thin device called a shim intercepts the data from the card’s chip during a transaction. It can manipulate the chip card’s information, though it’s not as simple as swiping data from a magnetic strip.

Detecting shimming can be tricky. If you notice any of the following signs, it could be a sign of shimming:

An ATM or payment terminal does not smoothly accept your chip card

The card reader feels loose or wobbly

The card reader is difficult to insert your card into

Always report any strange issues to your bank. Remember, every bit of information helps in the fight against skimming and shimming.

Summary

Staying vigilant and informed is our best line of defense against ATM skimming. By understanding what ATM skimmers are, recognizing the key indicators, taking proactive measures, and understanding the risks, we can significantly reduce the chances of falling victim to this nefarious practice.

Even as technology evolves, and threats like shimming emerge, we can stay one step ahead by remaining alert and reporting any suspicious activity. Remember, your financial safety is in your hands!