Cybersecurity threats are a critical concern for businesses in the digital age. As technology advances, the risk of cyber-attacks and data breaches continues to rise, making safeguarding our sensitive information more crucial than ever.

This is where cyber insurance comes in.

This article will explore cyber insurance, how it works, and why your business should consider a policy.

On This Page:

What is Cyber Insurance?

Cyber insurance is a policy designed to protect individuals and businesses from the financial losses and liabilities associated with cyber-attacks and data breaches. Cyber attacks can take many forms, including hacking, phishing, social engineering, or ransomware. They can result in the theft or destruction of sensitive financial or private information, reputational damage, and legal expenses.

Cybersecurity insurance can help cover recovery costs, including investigation and remediation, notification of affected parties, legal fees, and other expenses associated with the fallout of a cyber attack. Cyber insurance provides a safety net for individuals and businesses falling victim to cybercrime, and it can help them recover from these incidents’ financial losses and legal liabilities.

Cybersecurity insurance can be broadly classified into two categories: first-party and third-party coverage:

- First-Party Coverage: First-party cyber insurance policies cover the direct costs incurred by an organization in response to a cyber incident, such as the costs of investigating the incident, restoring data and systems, and notifying affected parties.

- Third-Party Coverage: Third-party cyber insurance policies cover the costs associated with lawsuits and legal claims against an organization by third parties due to a cyber incident, such as customers or business partners.

Summary: Cyber insurance protects against financial losses and liabilities from cyber-attacks and data breaches. It covers the recovery costs, including investigation, notification, legal fees, and other expenses.

Why Is Cyber Insurance Important?

Cybersecurity issues have become a significant worry as technology becomes more crucial to businesses. Cybercriminals are constantly evolving their tactics to stay ahead of security measures put in place by companies. This means that even if you think your organization is well-protected against cyber attacks, there’s no guarantee that it won’t be targeted or suffer a breach at some point.

According to the Internet Crime Complaint Center (IC3), the FBI receives complaints from 70,000 cyber victims each month, and there were over 20,000 complaints in 2022 alone from victims of the Business Email Compromise (BEC) scam.

Cyber insurance can provide peace of mind for business owners who want to ensure they’re covered in case something happens.

A good cyber insurance policy will provide the following:

- Financial Protection: Cyber insurance can protect against the costs associated with a cyber attack, such as data breach response costs, business interruption losses, and legal fees.

- Reputation Protection: A cyber attack can damage an individual or business’s reputation and have long-lasting consequences. Cyber insurance can cover the costs of managing a public relations crisis and rebuilding a damaged reputation.

- Regulatory Compliance: Many industries are subject to data privacy and security regulations, such as HIPAA, PCI-DSS, and GDPR. Cyber insurance can cover the costs associated with regulatory investigations and fines from a cyber incident.

- Peace of Mind: Cyber attacks can be complex and costly, and many individuals and businesses may not have the expertise or resources to respond effectively to a cyber incident.

- Risk Management: Cyber insurance can be a component of an overall risk management strategy for individuals and businesses. It can help identify and mitigate cybersecurity risks and provide a framework for responding to a cyber incident.

Related: Cybersecurity Guide for Businesses

Who Needs Cyber Insurance?

When it comes to cyber insurance, one size does not fit all. Every business should consider purchasing a policy that fits their needs and risk profile.

Here are a few examples:

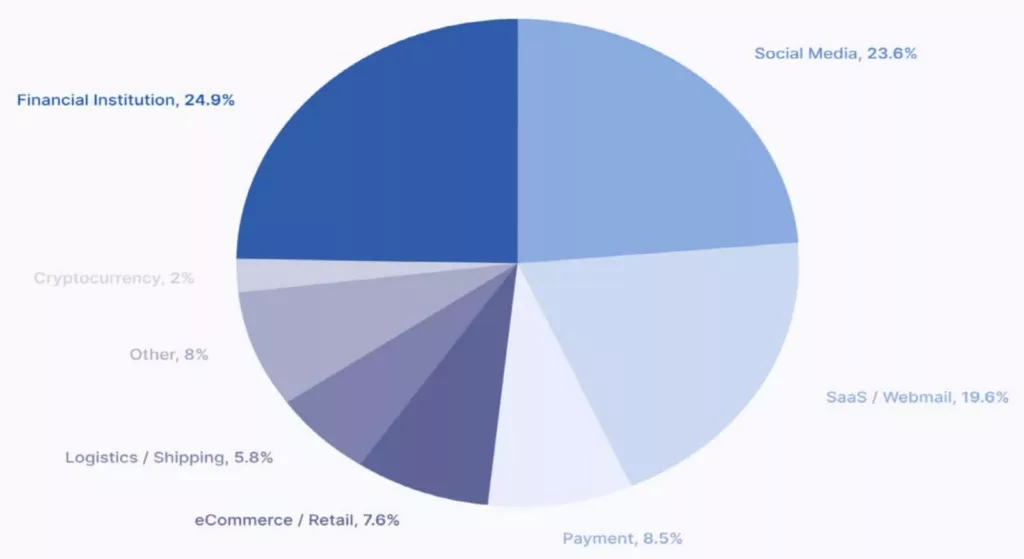

- SMBs are particularly vulnerable to cyber-attacks. While small businesses may think they are too insignificant for a hacker to target, the reality is that hackers often go after smaller organizations because they tend to have weaker security protocols in place.

- Financial institutions are subject to strict data privacy and security regulations, such as PCI-DSS, and handle sensitive financial information. Cyber insurance can cover the costs associated with regulatory investigations and fines resulting from a cyber incident.

- Healthcare providers are also subject to strict data privacy and security regulations, such as HIPAA, and handle sensitive patient information. Cyber insurance can cover the costs associated with regulatory investigations and fines resulting from a cyber incident.

- eCommerce companies handle sensitive customer data, such as credit card information, and may be vulnerable to cyber-attacks. Cyber insurance can provide financial protection and expert assistance in a data breach or other cyber incident.

- Law firms handle sensitive client information and are subject to strict ethical and legal obligations to protect client confidentiality. Cyber insurance can cover the costs of legal claims resulting from a cyber incident.

- Auto dealerships, increasingly reliant on technology in recent years, have become prime targets for hackers looking to steal sensitive customer information stored within dealer databases.

Ultimately, any individual or business that handles sensitive information or relies on technology to conduct business should consider cyber insurance.

Related: The Cyber Insurance Landscape (PDF)

What Does Cyber Insurance Cover (and Exclude)?

Cyber insurance policies can vary in coverage and exclusions, but here are some common areas that may be covered and excluded:

Commonly Covered:

- Data Breach Response Costs: Cyber insurance policies typically cover the costs associated with responding to a data breach, including expenses related to notifying affected individuals or organizations, hiring forensic investigators to identify the cause and scope of the breach, and legal fees.

- Business Interruption: Cyber insurance policies may cover financial losses that result from a cyber attack, including loss of income or revenue due to system downtime or interruptions in business operations.

- Cyber Extortion and Ransomware: Cyber insurance policies may cover costs related to cyber extortion and ransomware attacks. This can include expenses associated with negotiating with hackers, paying ransoms, or recovering data.

- Privacy Liability: Cyber insurance policies may cover legal costs and damages related to privacy violations, such as unauthorized access to or disclosure of personal information.

- Network Security Liability: Cyber insurance policies may cover legal costs and damages related to network security breaches, such as unauthorized access to or destruction of data.

- Multimedia Liability: Cyber insurance policies may cover legal costs and damages related to online content, such as intellectual property infringement or defamation.

Commonly Excluded:

- Intentional Acts: Cyber insurance policies may exclude coverage for intentional acts, such as cyber-attacks perpetrated by the insured or its employees.

- War or Terrorism: Cyber insurance policies may exclude coverage for cyber attacks resulting from war or terrorism.

- Bodily Injury or Property Damage: Cyber insurance policies may exclude coverage for bodily injury or property damage resulting from a cyber incident.

- Failure to Follow Cybersecurity Protocols: Cyber insurance policies may exclude coverage for losses resulting from failing to follow established cybersecurity protocols or implementing reasonable security measures.

- Pre-existing Conditions: Cyber insurance policies may exclude coverage for losses resulting from cyber incidents before the policy was in effect.

Key Takeaway: Cyber insurance can cover costs related to data breach response, business interruption, cyber extortion, privacy liability, network security liability, and multimedia liability. However, intentional acts, war or terrorism, bodily injury or property damage, failure to follow cybersecurity protocols, and pre-existing conditions may not be covered.

Cyber insurance is essential for businesses seeking to safeguard themselves from the economic repercussions of malicious cyber conduct. It can cover everything from legal fees related to data breaches, GDPR fines, and phishing attacks through identity theft incidents – but be sure to read up on what’s included in your policy before signing it off.

How Do I Get Cyber Insurance?

Start by contacting an insurance agent or broker who specializes in cyber insurance. They can help you assess your specific cybersecurity risks and needs and recommend appropriate coverage options. Consider any discounts that may apply due to industry standards or certifications your company holds (e.g., ISO 27001).

Below, we listed some of the best cyber security companies on the market to get you on a head start.

You’ll need to contact the insurance provider and discuss your needs to determine the best policy for your business. Be sure to ask questions about coverage limits, exclusions, and any additional services that may be included in the policy, such as employee risk assessment or security training.

You’ll likely be asked to provide information about your business or organization, such as your industry, size, revenue, and the types of data you handle. You may also need to provide details about your current cybersecurity practices and any previous cyber incidents. The insurance provider will evaluate your application and provide a quote for coverage.

What to Look For in a Cyber Insurance Policy

Selecting the right cyber insurance policy is essential for protecting your business or organization from financial losses from a cyber incident. However, with so many policies and providers available, knowing what to look for in a policy can take time and effort.

Here’s what to look out for:

- Coverage: Look for a policy that covers your business or organization’s specific cybersecurity risks and needs. Carefully review the covered and excluded risks and determine if the coverage limits are sufficient.

- Cost: Compare the price of different policies and consider the deductible, premium, and any additional fees or expenses.

- Reputation: Research the insurance provider’s reputation and financial stability. Look for reviews and ratings from other policyholders and check their financial strength ratings with independent rating agencies.

- Services: Consider any additional services or resources the insurance provider offers, such as cyber risk assessment, breach response planning, or cybersecurity training.

- Claims Process: Understand the claims process and how quickly and efficiently the insurance provider will respond to a cyber incident. Look for policies that provide 24/7 support and a dedicated claims team.

- Policy Language: Carefully review the policy language to ensure that you understand the terms and conditions of coverage, including any exclusions or limitations.

- Compliance: Ensure the policy complies with the relevant laws and regulations, such as the General Data Protection Regulation (GDPR) or the California Consumer Privacy Act (CCPA).

Best Cyber Insurance Companies

The best cyber insurance company for your business or organization depends on your specific cybersecurity risks and needs, as well as your budget and preferences. Some of the top cyber insurance providers that are well-regarded by industry experts and policyholders include:

Chubb

Chubb is a leading global insurance provider that offers customizable cyber insurance coverage for businesses of all sizes. Their policies help companies prepare for, prevent, and respond to cyber incidents, focusing on risk management and incident response services. Chubb’s cyber insurance coverage includes first-party and third-party cyber liability coverage, as well as business interruption, cyber extortion, and reputational damage protection.

AIG

AIG is another global insurance provider that offers comprehensive cyber insurance coverage. Their policies cover a range of cyber risks, including data breaches, system failures, and cyber attacks. AIG’s cyber insurance coverage includes data breach response, business interruption, and cyber extortion protection, as well as coverage for third-party claims related to privacy and security breaches.

Travelers

Travelers is a leading insurance and risk management service provider, offering tailored cyber insurance coverage for small to mid-sized businesses. They provide first-party and third-party cybersecurity liability insurance for data breaches, cyber-attacks, and business interruptions.

Cowbell

Cowbell Cyber Insurance is a notable cyber insurance provider for small and mid-sized businesses. They offer customized coverage for data breaches and cyber-attacks and use AI and machine learning to provide cyber risk assessments. Cowbell also provides risk management services such as security testing and employee training.

Beazley

Beazley is a specialty insurance provider focusing on cyber insurance for healthcare organizations. Their policies cover regulatory compliance, data privacy, network security liability, and first-party coverage for business interruption and data recovery. Beazley also offers a range of risk management services, such as vulnerability scanning, security testing, and employee training.

Hiscox

Hiscox is a provider of small business insurance, offering cyber insurance coverage for companies with up to $1 billion in revenue. Their policies cover data breaches, cyber-attacks, and media liability. Hiscox’s cyber insurance coverage includes data breach response, cyber extortion protection, and regulatory fines and penalties coverage.

Cyber Insurance FAQs

Is Cyber Insurance Worth It?

Yes, cyber insurance can be worth it for businesses that handle sensitive customer information or rely heavily on technology. However, it is essential to evaluate the costs and coverage of policies to ensure they match specific needs and risks. Additionally, cyber insurance is one component of a broader cybersecurity strategy that includes measures to prevent and respond to cyber incidents.

How Much Does Business Cyber Insurance Cost?

While cybersecurity insurance costs vary depending on many factors, most businesses can expect to pay between $500 and $2,000 annually for their policy.

What is Cyber Liability Insurance?

Cyber liability coverage protects customers from the risk and potential damages a company or organization may face due to a data breach, network security failure, or other cyber-related incidents. These incidents may lead to the theft, destruction, or unauthorized access of sensitive data, such as customer information, financial records, or intellectual property.

Cyber liability insurance policies cover damages, losses, and expenses resulting from such incidents, including legal fees, notification costs, and credit monitoring for affected customers. These policies may also offer assistance in cybersecurity risk assessments, incident response planning, and crisis management.

When did cybersecurity insurance start?

Cyber insurance emerged in the mid-1990s as a response to the growing prevalence of cyber attacks and the need for businesses to manage associated risks. Over time, cyber insurance has evolved to cover a range of cybersecurity threats, including data breaches, cyber-attacks, and business interruption. It has become an essential component of many businesses’ risk management strategies.

Conclusion

Cybersecurity insurance is essential for businesses and individuals in today’s digital age. The potential financial and reputational damage can be significant with the increasing frequency and severity of cyber attacks. Cyber insurance provides a safety net by covering costs associated with data breaches, cyber-attacks, and other online threats.

However, selecting the right policy can be complex, and working with a trusted insurance provider who can tailor coverage to meet specific needs is essential. By understanding the basics of cybersecurity insurance and mitigating cyber risks, individuals and businesses can protect themselves and their assets from the ever-present threat of cybercrime.